| 글로벌 자동차 선루프 시장은 2023년에 107억 달러에 도달했으며, 2032년까지 200억 달러에 이를 것으로 예상됩니다. 이 기간 동안 연평균 성장률(CAGR)은 6.9%에 이를 것으로 보입니다. 시장 성장은 다양한 기술 발전, 파노라마 선루프에 대한 수요 증가, 경제적이고 효율적인 전기 및 하이브리드 차량에 대한 소비자의 선호 증가에 의해 주도되고 있습니다. 시장 세분화에서는 선루프 유형, 재료, 작동 방식, 차량 유형 및 유통 채널에 따라 분석하였습니다. 내장형 선루프 시스템이 시장 점유율에서 가장 큰 비중을 차지하고 있으며, 유리 재료가 가장 높은 시장 점유율을 보이고 있습니다. 선루프의 작동 방식 중에서는 자동 선루프가 주도적이며, 프리미엄 및 고급 차량이 시장에서 가장 큰 점유율을 차지하고 있습니다. 유통 채널에서는 오리지널 장비 제조업체가 가장 큰 비중을 차지하고 있습니다. 유럽은 자동차 선루프 시장에서 가장 큰 지역 시장으로, 독일, 프랑스, 영국이 주요 국가로 꼽힙니다. 유럽의 선루프 시장은 기술 발전과 소비자의 선호 변화에 힘입어 성장하고 있으며, 다양한 자동차 선루프 기업들이 경쟁력을 유지하기 위해 투자를 하고 있습니다. 시장 성장의 주요 동향으로는 파노라마 선루프에 대한 수요 증가, 최신 기술의 도입, 전기 및 하이브리드 차량에 대한 선호가 있습니다. 또한, 선루프 제조업체들은 안전 기준과 환경 규제를 준수하기 위해 지속적인 혁신과 개발을 요구받고 있습니다. 경쟁 환경에서는 Aisin Corporation, Webasto SE, Magna International과 같은 주요 기업들이 시장에서 활발히 활동하고 있으며, 혁신적인 선루프 디자인과 기능을 도입하기 위해 연구 및 개발에 투자하고 있습니다. 이러한 동향은 향후 시장 전망을 긍정적으로 이끌 것으로 예상됩니다. |

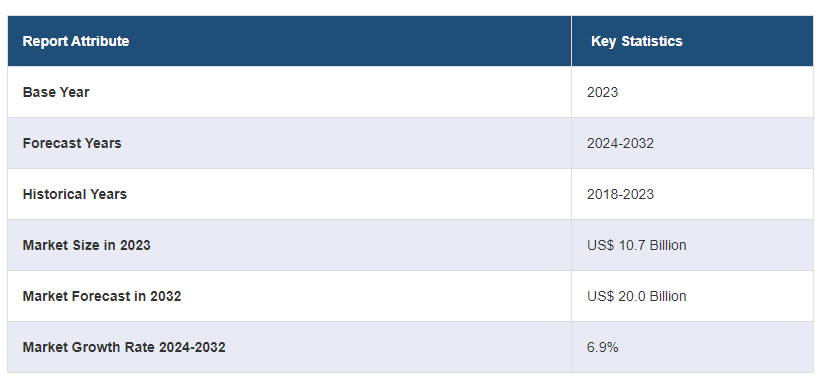

The global automotive sunroof market size reached US$ 10.7 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 20.0 Billion by 2032, exhibiting a growth rate (CAGR) of 6.9% during 2024-2032. The market is primarily driven by various technological advancements, the growing demand for panoramic sunroofs, and the rising inclination of users toward electric and hybrid vehicles that are cost-effective and offer improved efficiency.

Report Attribute

Key Statistics

Base Year

2023

Forecast Years

2024-2032

Historical Years

2018-2023

Market Size in 2023 US$ 10.7 Billion

Market Forecast in 2032 US$ 20.0 Billion

Market Growth Rate 2024-2032 6.9%

Automotive Sunroof Market Analysis:

Major Market Drivers: The increasing consumer interest in vehicles that provide an enhanced driving and comfort experience is escalating the market growth. In addition, the growing emphasis on vehicle aesthetics and design, especially within the ultra-luxury and luxury segments, is pushing the demand for sunroofs, making them a desirable feature.

Key Market Trends: The market is witnessing a shift toward larger panoramic sunroofs that offer passengers a more expanded and immersive experience.

Geographical Trends: Some of the major market players in the automotive sunroof industry include Aisin Corporation, Automotive Sunroof-Customcraft (ASC) Inc., Beijing Automotive Group Co. Ltd., BOS Group, CIE Automotive, Inteva Products LLC, Johnan America Inc., Magna International Inc., MITSUBA Corporation, Webasto SE, and Yachiyo Industry Co. Ltd. (Honda Motor Company Ltd.). among many others.

Challenges and Opportunities: The market is facing challenges with adhering to safety standards and environmental regulations which are hurdles for sunroof manufacturers, requiring ongoing compliance and innovation. Besides this, various opportunities are emerging from evolving consumer preferences, notably the increasing interest in electric and hybrid vehicles, which may necessitate the development of lightweight and energy-efficient sunroof solutions.

Global Automotive Sunroof Market

Automotive Sunroof Market Trends:

Rising Demand for Panoramic Sunroofs

The changing consumer taste for panoramic sunroofs in the automotive market is influencing market growth. In addition, panoramic sunroofs are distinguished by their expansive design that spans the majority of the vehicle’s roof and become sought after by consumers seeking to enhance their driving experience. These sunroofs offer a larger opening compared to traditional models, providing occupants with an unparalleled sense of openness and spaciousness within the vehicle cabin. Besides, various key players are investing in roof systems to stay ahead of the competition. For instance, in June 2021, Webasto, a global frontrunner in roof systems, furnished the sleek sliding panorama sunroof for the latest Mercedes-Benz S-Class. This expansive glass feature enhances the sedan’s interior with a pleasingly luminous atmosphere, allowing users to adjust easily shading to their preference through two independently controllable roller blinds.

Advanced Technologies

The market has witnessed a significant evolution with the incorporation of advanced technologies aimed at enhancing user convenience, safety, and overall driving experience. Sunroof manufacturers are continuously innovating to reach the demands of modern consumers, with engulfing features such as power-operated systems, touch-sensitive controls, and built-in sunshade mechanisms. Nowadays, the automotive sunroof market demands key players to undertake strategic collaborations and invest in technological advancements to stay ahead of the competition. For instance, Gabriel India entered into a technical collaboration and alliance agreement with Inalfa Roof Systems, a company with a valuation of $1.5 billion (Rs twelve thousand three hundred seventy (12,370) crores). It aims to produce sunroofs within India, acknowledging Gabriel India to establish a wholly-owned subsidiary named Inalfa Gabriel Sunroof Systems (IGSS) near Chennai, which will focus on manufacturing sunroofs for passenger vehicles. Operations are scheduled to commence by March 2024, with an estimated investment of $22 million (Rs. one hundred eighty-one crores 181).

Growing Preference for Electric and Hybrid Vehicles

The automotive industry is widely adopting electric and hybrid vehicles, driven by growing environmental awareness and stringent emissions regulations. This shift towards electrification is also influencing the automotive sunroof market, prompting manufacturers to develop lightweight and energy-efficient sunroof solutions. For instance, in January 2022, Mercedes-Benz announced the Vision EQXX, an innovative electric vehicle equipped with slim crystalline solar cells integrated into its roof. These cells harness energy to operate the car’s lighting, infotainment system, climate control, and other features.

Automotive Sunroof Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2024-2032. Our report has categorized the market based on type, material, operation, vehicle type, and distribution channel.

Breakup by Type:

Built-in Sunroof System

Tilt and Slide Sunroof System

Panoramic Sunroof System

Others

Built-in sunroof system accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes a built-in sunroof system, tilt and slide sunroof system, panoramic sunroof system, and others. According to the report, the built-in sunroof system represented the largest segment.

Built-in sunroofs refer to sunroofs integrated seamlessly into the roof of a vehicle, giving them a smooth and streamlined appearance. They are popular sunroof systems and are standard or optional with a large number of modern vehicles due to their aesthetic appeal. For instance, KIA corporation, a prominent automaker introduced its unique Kia Seltos providing a captivating experience. It has a panoramic sunroof, providing a new look and helping the company improve its product offering while increasing its revenue share.Top of Form

Breakup by Material:

Glass

Fabric

Others

Glass holds the largest share of the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes glass, fabric, and others. According to the report, glass accounted for the largest market share.

Glass is the most substantial segment in the market. It is associated with a glass sunroof having several advantages which offer unobtrusive and clear view. It significantly impacts the overall driving experience of consumers. Hence, several leading players are making acquisitions to stay ahead of the competition. For instance, in August 2022, Webasto, a global systems partner in the mobility sector, announced the acquisition of Carlex Glass Luxembourg SA, located in Grevenmacher, Luxembourg. The facility manufactures glass components for passenger vehicles and supplies a variety of international automotive manufacturers.

Breakup by Operation:

Automatic

Manually Operated

Automatic represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the operation. This includes automatic and manually operated. According to the report, automatic represented the largest segment.

Automatic sunroofs are easy to operate as they are movable by a push of a button or operated by a sensor. The automatic sunroofs market dominance is due to the modern need-based consumers, the features included in the user experience areas are influencing the market growth. Automatic operation aligns with the varying needs of advancement toward enhanced comfort and technology integration to offer a premium experience. Moreover, leading players are investing in the automotive sunroof material market to stay ahead of the competition. For instance, in February 2021, BMW introduced the BMW X3 xDrive30i Sport X automatic transmission model in India with a price tag of INR 56.5 lakh. This latest addition to the lineup offers a relaxed atmosphere due to its optimized cabin noise insulation, rear window sunblind, and a huge panoramic sunroof which is manufactured at the BMW Group Plant Chennai.

Breakup by Vehicle Type:

Mid-range Vehicles

Premium and Luxury Vehicles

Premium and luxury vehicles exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes mid-range vehicles, and premium and luxury vehicles. According to the report, premium and luxury vehicles accounted for the largest market share.

The premium and luxury vehicles offer extra features to ensure riders can enjoy high levels of comfort and style at a go. The automotive sector is innovating abundant premium and luxury vehicles for consumers to enjoy a custom experience during driving. Currently, the automotive sunroof market involves several leading players investing in the market to stay ahead of the competition. For instance, On the nineteenth of March 2024, BMW 620d M Sport Signature debuted in India with 78.90 Lakh, which is a premium and luxury vehicle offering various features such as BMW twinpower turbo diesel engine, comfort access system & soft close doors as standard, BMW display key with remote control parking, comfort seats lapped in leather Dakota with exclusive stitching for an elevated luxury experience, and offers a two-part panoramic glass sunroof that adds bright natural sunlight and improve the sense of spaciousness in the cabin.

Breakup by Distribution Channel:

Original Equipment Manufacturers

Aftermarket

Original equipment manufacturers dominate the market

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes original equipment manufacturers, and aftermarket. According to the report, original equipment manufacturers represented the largest segment.

The original equipment manufacturers benefit from new vehicles that are equipped with them at the factory. These market leaders have the advantage of providing sunroof as an available option in their line-up, hence encouraging customers to expect automotive sunroof to be of a factory-standard qualities. Recently, in November 2023, Minda Corporation announced that it has entered into an agreement to establish a joint venture with HSIN Chong Machinery Works, a company based in Taiwan. The collaboration aims to manufacture sunroofs for passenger vehicles.

Breakup by Region:

North America

United States

Canada

Asia-Pacific

China

Japan

India

South Korea

Australia

Indonesia

Others

Europe

Germany

France

United Kingdom

Italy

Spain

Russia

Others

Latin America

Brazil

Mexico

Others

Middle East and Africa

Europe leads the market, accounting for the largest automotive sunroof market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market in automotive sunroof market.

Europe is dominating the automotive sunroof market across the globe. It is led by developed countries such as Germany, France, and the United Kingdom. Europe’s lead in the auto sunroof market stems from its technological advancements and the changing user’s preference for vehicles equipped with sunroofs. As a result, various automotive sunroof companies are investing in the market to stay ahead of the competition. For instance, In March 2024, AGC Automotive Europe headquartered in Belgium, introduced the AGC panoramic vehicle-integrated photovoltaic (VIPV) sunroof designed for passenger vehicles, including sedans, SUVs, and minivans which offers power outputs ranging from 170 W to 380 W, varying based on the available area for photovoltaic utilization.Top of Form

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the automotive sunroof industry include Aisin Corporation, Automotive Sunroof-Customcraft (ASC) Inc., Beijing Automotive Group Co. Ltd., BOS Group, CIE Automotive, Inteva Products LLC, Johnan America Inc., Magna International Inc., MITSUBA Corporation, Webasto SE, and Yachiyo Industry Co. Ltd. (Honda Motor Company Ltd.).

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

At present, leading players in the market are engaging in several strategic initiatives to maintain and enhance their market position. These initiatives include research and development efforts aimed at introducing innovative sunroof designs with enhanced features such as panoramic sunroofs, smart glass technology, and integrated shading systems. Consequently, the automotive sunroof market involves several leading players investing in the market to stay ahead of the competition. For example, In March 2023, AISIN’s panoramic sunroof was incorporated into the EQS SUV and the EQE SUV, the flagship models of Mercedes-Benz’s electric vehicle brand, Mercedes-EQ which marks the inaugural inclusion of an AISIN sunroof in Mercedes-Benz’s electric vehicle lineup. These developments are expected to create a favorable market outlook in coming years.

Automotive Sunroof Market News:

February 2023: Vayve Mobility, an Indian startup, unveiled its plans to introduce a solar-powered electric car named Eva equipped with 150-watt solar panels integrated into its sunroof, providing a daily range of 10-12 km or a yearly range of 3,000 km.

1 머리말

2 연구 범위 및 방법론

2.1 연구 목적

2.2 이해관계자

2.3 데이터 출처

2.3.1 1차 출처

2.3.2 보조 출처

2.4 시장 추정

2.4.1 상향식 접근 방식

2.4.2 하향식 접근 방식

2.5 예측 방법론

3 요약

4 소개

4.1 개요

4.2 주요 산업 동향

5 글로벌 자동차 선루프 시장

5.1 시장 개요

5.2 시장 성과

5.3 COVID-19의 영향

5.4 시장 전망

6 유형별 시장 세분화

6.1 내장형 선루프 시스템

6.1.1 시장 동향

6.1.2 시장 예측

6.2 틸트 및 슬라이드 선 루프 시스템

6.2.1 시장 동향

6.2.2 시장 예측

6.3 파노라마 선 루프 시스템

6.3.1 시장 동향

6.3.2 시장 예측

6.4 기타

6.4.1 시장 동향

6.4.2 시장 예측

7 재료 별 시장 세분화

7.1 유리

7.1.1 시장 동향

7.1.2 시장 예측

7.2 직물

7.2.1 시장 동향

7.2.2 시장 예측

7.3 기타

7.3.1 시장 동향

7.3.2 시장 예측

8 운영별 시장 세분화

8.1 자동

8.1.1 시장 동향

8.1.2 시장 예측

8.2 수동 작동

8.2.1 시장 동향

8.2.2 시장 예측

9 차량 유형별 시장 세분화

9.1 미드 레인지 차량

9.1.1 시장 동향

9.1.2 시장 예측

9.2 프리미엄 및 고급 차량

9.2.1 시장 동향

9.2.2 시장 전망

10 유통 채널별 시장 세분화

10.1 오리지널 장비 제조업체

10.1.1 시장 동향

10.1.2 시장 전망

10.2 애프터 마켓

10.2.1 시장 동향

10.2.2 시장 예측

11 지역별 시장 세분화

11.1 북미

11.1.1 미국

11.1.1.1 시장 동향

11.1.1.2 시장 예측

11.1.2 캐나다

11.1.2.1 시장 동향

11.1.2.2 시장 예측

11.2 아시아 태평양

11.2.1 중국

11.2.1.1 시장 동향

11.2.1.2 시장 예측

11.2.2 일본

11.2.2.1 시장 동향

11.2.2.2 시장 예측

11.2.3 인도

11.2.3.1 시장 동향

11.2.3.2 시장 예측

11.2.4 대한민국

11.2.4.1 시장 동향

11.2.4.2 시장 예측

11.2.5 호주

11.2.5.1 시장 동향

11.2.5.2 시장 예측

11.2.6 인도네시아

11.2.6.1 시장 동향

11.2.6.2 시장 예측

11.2.7 기타

11.2.7.1 시장 동향

11.2.7.2 시장 예측

11.3 유럽

11.3.1 독일

11.3.1.1 시장 동향

11.3.1.2 시장 예측

11.3.2 프랑스

11.3.2.1 시장 동향

11.3.2.2 시장 예측

11.3.3 영국

11.3.3.1 시장 동향

11.3.3.2 시장 예측

11.3.4 이탈리아

11.3.4.1 시장 동향

11.3.4.2 시장 예측

11.3.5 스페인

11.3.5.1 시장 동향

11.3.5.2 시장 예측

11.3.6 러시아

11.3.6.1 시장 동향

11.3.6.2 시장 예측

11.3.7 기타

11.3.7.1 시장 동향

11.3.7.2 시장 전망

11.4 라틴 아메리카

11.4.1 브라질

11.4.1.1 시장 동향

11.4.1.2 시장 예측

11.4.2 멕시코

11.4.2.1 시장 동향

11.4.2.2 시장 예측

11.4.3 기타

11.4.3.1 시장 동향

11.4.3.2 시장 예측

11.5 중동 및 아프리카

11.5.1 시장 동향

11.5.2 국가 별 시장 세분화

11.5.3 시장 예측

12 SWOT 분석

12.1 개요

12.2 강점

12.3 약점

12.4 기회

12.5 위협

13 가치 사슬 분석

14 포터의 다섯 가지 힘 분석

14.1 개요

14.2 구매자의 협상력

14.3 공급자의 협상력

14.4 경쟁의 정도

14.5 신규 진입자의 위협

14.6 대체재의 위협

15 가격 분석

16 경쟁 환경

16.1 시장 구조

16.2 주요 플레이어